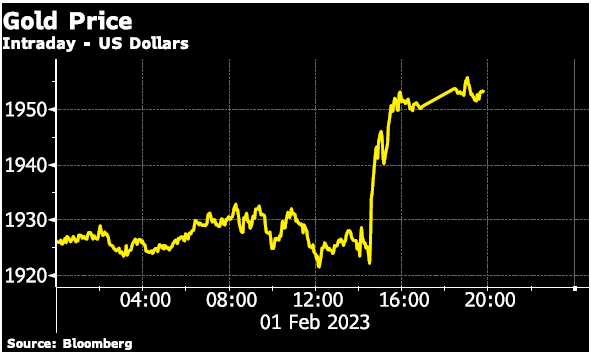

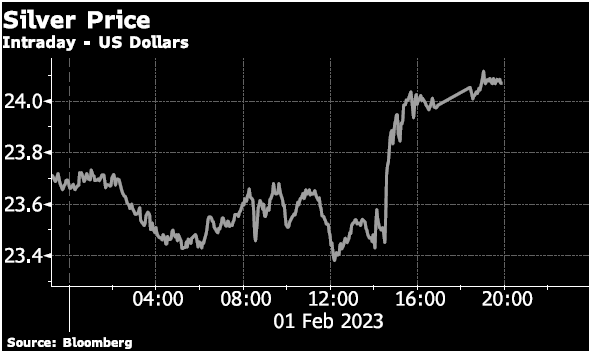

Those watching the gold price and price of silver will have noticed the sharp uptick following the Federal Reserve’s announcement, yesterday. This was despite the Fed doing exactly what everyone expected them to do. For now, the Federal Reserve is sticking to its relatively well-telegraphed plan but how long will it be until they need to move the goalposts in order to do so?

Gold and Silver prices rose sharply on the Fed’s statement on Wednesday. The change of tune from ‘higher interest rates are needed to fight inflation” to “we might have raised enough and need slow down increases to see” was apparent in both the statement released after the interest rate setting committee’s two-day meeting and in Chair Powell’s press conference.

The committee voted unanimously to raise the fed funds rate by only 0.25% this time around. Also, hinted that there might only be one more similar hike at their next meeting on March 21-22.

The Committee will also update their economic projections and their outlook for the fed funds rate at the March meeting.

Download Your Free Guide

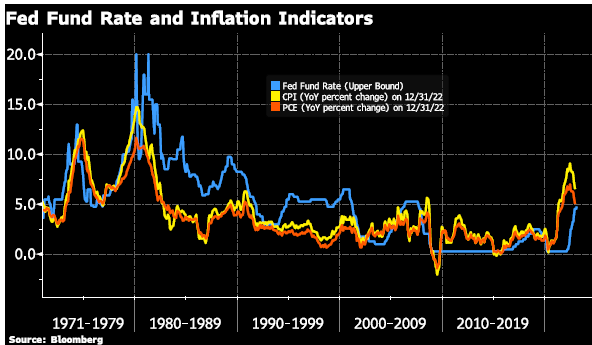

After the December projections showed that Fed committee members had increased their projection for the fed funds rate at the end of 2023 from the September projections, we wrote (See our December 15, 2022 post Has the Fed reached peak hawkishness?) that the Fed had reached peak hawkishness. Also, they would start downgrading the speed of interest rate increases and the next projections would backtrack to lower fed funds projections over the next two years.

Although inflation growth has declined from 40-year peaks in the middle of last year it still remains above the Fed’s two percent inflation growth goal. The Fed is especially focused on a subset of inflation, now monikered “Supercore Inflation”. This so-called Supercore Inflation focuses on the service sector (minus housing services) – these services are generally more sensitive to wage growth.

Services such as lawyers, hairdressers, teachers, and dental services are more likely to be sensitive to the cost of labour than say iPhones which are more sensitive to things like global supply chains and international forces.

The service sector, especially in the hospitality sector (hotels and restaurants) still has more job openings than workers looking for jobs, which also drives wages higher. The theory is that rising wages then increase the cost of services – which increases core inflation further.

Is Supercore inflation overdue?

There is still an argument to be made that the rise in wages in the service sector is an overdue adjustment to the U.S. economy – as wages have been stagnant in this sector for many years. This has added to the growing wealth inequality in the U.S.

The Fed posted a study on October 22, 2021, titled “Wealth Inequality and the Racial Wealth Gap” which showed that the wealth gap has widened notably over the past few decades in the United States. The average Black and Hispanic or Latino households earn about half as much as the average White household and own only about 15 to 20 percent as much net wealth.

This long overdue structural reset is one reason that we think inflation could run higher than pre-covid levels for some years to come. But the Fed is limited in its options to raise interest rates much higher and instead will start discussing raising the target inflation rate from 2% to something in the 3%-4% range.

See our primer on how central banks set the 2% target in the first place from May 26, 2022 Did Central Banks arrive at their Target Inflation Rate by Mere Fluke? And our post on November 4 Fed will collapse the economy and be forced to pivot which discussed the pivot within the pivot and the benefits of changing the inflation target rates for central banks.

Gold, Rate Hikes and The Central Bank Illusion?

One last item to keep in mind over the next several months is that the Fed’s statement says The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.

The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Although Chair Powell refused to answer any questions on the subject – the Federal Reserve is the fiscal agent of the US Treasury and as the Debt Ceiling Debate rages on the Fed needs to be prepared to step in if Congress does not come to an agreement on raising the debt ceiling.

Central banks backing off interest rate hikes, higher inflation, and central bank buying are all positive for gold and silver in 2023.

From The Trading Desk

Market Update

The much anticipated Fed meeting took place on Wednesday.

The market was expecting a 25bp rise marking its eighth straight rate hike since last March and raising the bank’s benchmark lending rate to 4.5%-4.75%.

The Fed noted that it doesn’t expect higher rate increases in the future, but did suggest another 25bp rate in its next meeting and going forward.

Markets, however, were looking to this week’s meeting for signs that the Fed would be ending the rate increases soon.

But the statement provided no such signals. At first, stocks fell in the wake of the announcement, with the Dow Jones Industrial Average tumbling more than 300 points.

Shortly after Powell’s press conference, the markets rebounded after he acknowledged that “the disinflationary process” had started.

The dollar also fell sharply on the news of a lower rate hike and pushed gold higher, smashing past the $1,950 resistance level for the first time in almost a year.

Across the pond, the BoE and ECB both made their first policy announcements of 2023, today. Both central banks were forecast to raise their benchmark rates by 50 basis points as they seek to tame inflation, neither disappointed.

This is the BoE 10th rise since December 2021, is it any surprise that this decision has pushed interest rates to the highest level in 15 years?

What are we seeing at GoldCore? With storm clouds still forming, threats of war, and inflation still menacing, we continue to see customers stacking gold and silver.

2023 looks to be a bright year for both metals giving our customers confidence to ride out the storm.

Stock Update

Gold Brittania’s & Silver Britannia’s are on offer for UK storage or delivery. For the next 2 weeks we have Gold Britannia’s on offer at 4% over spot and Silver Britannia’s at 35% over spot. This is a fantastic opportunity to add the Queen Elizabeth II motif to your collection as The Royal Mint will not produce these again!

GoldCore have excellent stock and availability on all Gold Coins and bars. Please contact our trading desk with any questions you may have.

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

01-02-2023 1925.60 1925.90 1563.39 1561.33 1768.66 1766.63

31-01-2023 1905.20 1923.90 1546.83 1562.01 1759.83 1772.87

30-01-2023 1926.75 1924.10 1552.00 1554.48 1765.67 1766.32

27-01-2023 1928.25 1923.05 1558.03 1553.44 1770.71 1769.98

26-01-2023 1936.45 1932.45 1562.52 1561.61 1776.31 1774.96

25-01-2023 1925.85 1930.80 1565.52 1562.21 1771.40 1772.28

24-01-2023 1936.50 1920.75 1573.60 1565.41 1782.94 1771.70

23-01-2023 1927.20 1914.85 1556.02 1550.26 1768.01 1763.39

20-01-2023 1928.75 1924.90 1560.55 1557.24 1778.89 1778.80

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here